Are you planning to start a business in Malaysia? Well done on that! Malaysia has become a hotspot for foreign entrepreneurs with its vibrant economy, business-friendly policies, and strategic location. Whether you’re launching a startup or expanding an existing business, company incorporation in Malaysia offers plenty of opportunities.

This blog will cover everything you need to know about starting a business in Malaysia as a foreigner, from selecting the right business structure to handling company registration, obtaining necessary licenses, and setting up a company in Malaysia while staying compliant with local laws.

Why is Malaysia an ideal destination for entrepreneurs?

Understanding why Malaysia is an excellent option for international business owners is crucial before beginning the incorporation process.

Ease of doing business:

One key benefit of setting up a company in Malaysia is the ease of doing business there. In the World Bank’s Ease of Doing Business Rankings 2020, Malaysia ranks 12th out of 190 countries.

For instance, starting and operating a local firm there is relatively easy, and foreigners can establish 100% foreign-owned businesses.

Favourable tax laws:

Additionally, Malaysia offers companies a wide range of tax incentives, such as the investment tax allowance given to companies operating in specified sectors, such as machinery.

Malaysia has also signed tax treaties with many countries to help foreign investors avoid double taxation. There is also no withholding tax on dividends paid outside of Malaysia.

Central business hub:

Situated in the heart of ASEAN, Malaysia offers easy access to markets like Singapore, Indonesia, Thailand, Vietnam, and China, making it an ideal hub for regional business expansion.

Robust Infrastructure & Skilled Workforce:

Malaysia boasts world-class logistics, highways, and ports and a highly skilled bilingual workforce fluent in English, Malay, and Mandarin, making business communication seamless for foreign investors.

Foreign business entity options available in Malaysia

The first thing to do when you’d like to start a business in Malaysia is to decide on the type of business entity that best suits your needs as a foreign investor; you have several options when choosing the legal structure of your business in Malaysia. The most common business entities include:

Sole Proprietorship

A sole proprietorship is the simplest form of business entity to establish. However, foreign entrepreneurs must have a permanent resident status in Malaysia to do so successfully.

Partnership

Like a sole proprietorship, all partners must be Malaysians or have permanent resident status to register a partnership.

Private Limited Company (Sdn Bhd)

A private limited company (Sdn Bhd) is one of foreign investors’ most common business entities. With a few exceptions, a private limited company lets foreigners own 100% of the business. In industries like agriculture, banking, education, and oil and gas, at least 50% of the company must be Malaysian-owned.

Please read our guide to learn more about Sendirian Berhad (Sdn Bhd) company in Malaysia and why it is the most popular choice for foreign investors.

Limited Liability Partnership (LLP

An LLP in Malaysia blends features of partnerships and companies. Foreigners can set one up without living in Malaysia, but they must appoint a compliance officer who is a Malaysian citizen, permanent resident, or local resident.

Public Limited Company (Berhad)

A Public Limited Company (“Berhad”) suits larger businesses looking to raise capital through public shares. Governed by the Companies Act 2016, it has stricter regulations and transparency requirements perfect for big ambitions.

Branch Office (Foreign Company

A branch office in Malaysia is an extension of a foreign parent company, which is responsible for its debts. Its activities must match the parent company’s, and it requires at least one Malaysian resident agent.

Representative Office

A representative office in Malaysia lets foreign companies explore the market and handle non-commercial activities like promotion, market research, and coordination. It can’t make profits, sign contracts, or trade, and the parent company is fully responsible for its debts and liabilities.

How to Register your business in Malaysia?

Choose a Business Name

Once you have chosen a suitable business entity, the next thing to do is to select a company name. The name must be unique and comply with the Companies Commission of Malaysia (SSM) guidelines. After you have decided on a name, you should run a name check with the Companies Commission of Malaysia (SSM). When the name check is completed, you can register the name with the SSM. Upon approval, the name will be reserved for your company.

Appointing key officials

- Directors: Minimum 1, natural person, aged 18+, Malaysian resident.

- Shareholders: Minimum 1, individual or corporate entity (can be a director).

- Company Secretary: SSM-licensed or member of a recognized professional body, appointed within 30 days.

Register Your Business with SSM

- For registering the business in Malaysia submit the required documents with SSM :

- Company name approval

- Business nature and details

- Details of shareholders and directors

- Constitution of the company (if applicable)

Business address/ premises

You will also need a business address or premises. This is essential for other steps like setting up a bank account and applying for work permits. For those residing in or intending to travel to Malaysia, you can rent an office or consider a virtual office to save costs.

Incorporation of company in Malaysia

The following incorporation documents must be prepared to set up an Sdn Bhd, Joint Venture Sdn Bhd in Malaysia:

- Constitution of the company

- Statutory declaration by a director or promoter, declaring that they are not undischarged bankrupts and have not been convicted of any offence

- Declaration of compliance with the requirements of the Companies Act

- Identity card of every director and company secretary

To incorporate an Sdn Bhd or Joint Venture Sdn Bhd, you must also submit the approval letter for the company’s name from SSM.

The incorporation documents must be submitted to SSM within 3 months of SSM approving the company’s name. If not, a new name search must be conducted.

Registration fee and certificate of registration

A registration fee is payable to set up a company in Malaysia. A Business Registration Certificate will be issued after the payment.

Once the registration is complete, the Companies Commission of Malaysia will issue the notice within one working day.

What Happens After Setting Up a Company in Malaysia?

Open a Business Bank Account

First, you’ll need a business bank account to separate your personal and company finances.

- Heads up: Opening an account can be tricky if you’re not in Malaysia. You’ll likely need to be there in person with a tourist visa, business visa, or work permit.

- If travelling isn’t an option, consider hiring a corporate services firm to help out.

Get Your Sales and Services Tax (SST) Number

After opening your bank account, the next step is to register for an SST number with Royal Malaysian Customs. This is a must if your revenue is expected to be more than RM500,000 before you can officially start doing business. You must submit company details, such as your registration number and email.

Apply for Licences (If needed)

Depending on your industry, you might need specific licenses to operate legally. For example, if you’re in food and beverage, land transportation, or tourism, you’ll want to get this sorted immediately.

Register Your Company as a Taxpayer

Next up is registering with the Inland Revenue Board of Malaysia (IRBM) to get your tax affairs in order. You’ll need to provide:

- Certificate of Incorporation (Form 9)

- Information about your managers, company secretary, and shareholders (Form 49)

- List of shareholders (Form 24)

Sign Up with the Employees’ Provident Fund (EPF)

If hiring employees, you must register with the EPF within seven days of bringing on your first hire. The process involves submitting forms like KWSP 1 and Form 49, along with documents like a director’s ID and proof of the first month’s payroll.

Prepare for Annual Audits

Annual audits are a legal requirement if your company is an Sdn Bhd or a Joint Venture Sdn Bhd. Labuan companies only need audits if they’re involved in trading.However, starting from January 1, 2025, certain private companies may qualify for audit exemptions under the new criteria introduced by the Companies Commission of Malaysia.

Hold Your Annual General Meetings (AGMs)

Remember to schedule your AGMs! Your first one should be held within 18 months of incorporation, and after that, once a year, with no more than 15 months between each meeting.

Documents for foreign company registration in Malaysia

To register a foreign company in Malaysia, you must prepare the following documents:

- A certified true copy of:

- The certificate of incorporation

- The company’s memorandum and articles of association

- A list of all foreign and local directors and their powers

- A memorandum of appointment or power of attorney under the seal of the foreign company wanting to incorporate in Malaysia

- A copy of the application and reservation of the company names

- A copy of the email for approval of the reservation of the company name

- A statutory declaration made by the agent of a company

- Registration fees

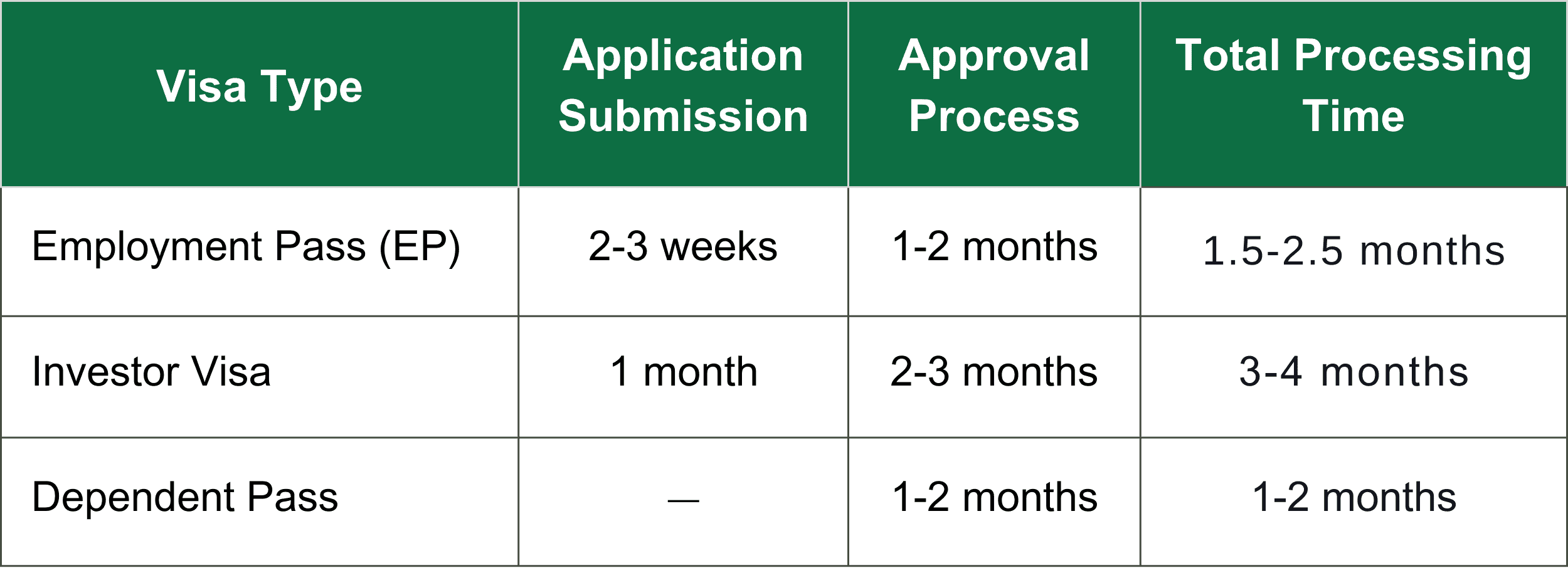

Visa & Work Permit Processing Times

Foreign business owners planning to relocate to Malaysia must obtain an Employment Pass (EP) or Investor Visa.

Common Challenges and How to Overcome Them

- Understanding Local Regulations: Work with a corporate service provider like 3E Accounting to ensure compliance.

- Finding a Local Director: If needed, professional firms can assist in appointing a nominee director.

- Banking Hurdles: Some banks require a strong local presence; working with a local consultant can ease the process.

- Language and Cultural Barriers: Hiring bilingual staff or a local consultant can help navigate communication gaps.

Conclusion:

Registering a business as a foreigner in Malaysia is straightforward, with the proper knowledge and preparation. By choosing

the right business structure, meeting legal requirements, and working with a professional incorporation specialist, you can successfully establish a business in Malaysia and leverage the country’s vast opportunities.

If you want to register a company in Malaysia, 3E Accounting Services can help you with the entire process, ensuring a smooth and hassle-free experience.

We understand the complexities of business registration, compliance, and taxation in Malaysia. With our cost-effective, efficient, and results-driven approach, we provide expert guidance to help you make informed decisions and ensure seamless business incorporation.

Ready to Start Your Malaysia Business Journey Today

Seamlessly set up your business in Malaysia with expert support from 3E Accounting Services. We’ll guide you through each step, ensuring a smooth process.

Frequently Asked Questions

A foreign company may carry on business in Malaysia by either: (a) incorporating as a local company; or. (b) registering the foreign company. Foreign company is defined under the Companies Act 2016 as: (a) a company, corporation, society, association or other body.

For “non-resident” status for Malaysia Sdn Bhd companies, the corporate tax rate will be a flat rate of 24%. “Non Resident” status is deemed for a company with more than 50% shareholding owned by foreigners.

The estimated initial cost to start a small to medium-sized business in Malaysia might range from RM 50,000 to RM 150,000. Here’s a rough breakdown: Company Incorporation and Licensing: RM 1,500 – RM 8,000. Office Space: RM 12,000 – RM 36,000 (for 12 months)

Common challenges include understanding local regulations, hiring local talent, and navigating industry-specific regulatory bodies.

To determine the best business to start in Malaysia, consider e-commerce, food and beverage, digital marketing, and tourism-related ventures due to their high demand and potential for growth in the Malaysian market.

No, it is not compulsory for a foreigner to be physically in Malaysia when he/she is filing for a registration stamp. The procedures are through MyCOID 2016 online portal but it requires one to have a Malaysian registered business address.

Abigail Yu

Author

Abigail Yu oversees executive leadership at 3E Accounting Group, leading operations, IT solutions, public relations, and digital marketing to drive business success. She holds an honors degree in Communication and New Media from the National University of Singapore and is highly skilled in crisis management, financial communication, and corporate communications.