Starting a business in Malaysia can be one of the most rewarding decisions you’ll ever make, but it begins with one of the most important steps: choosing the proper business structure. Whether you’re a local entrepreneur or a foreign investor, understanding your options to setup a company in Malaysia is crucial to ensuring smooth operations and compliance from the outset.

Malaysia offers various options for company setup, including sole proprietorships, partnerships, limited liability partnerships (LLPs), private limited companies (Sdn Bhd), and public limited companies (Berhad or Bhd). Each structure has its own unique legal, tax, and operational implications. Selecting the right one impacts everything from your liability and tax obligations to how easily you can attract investors or scale your business.

At 3E Accounting Services, we specialise in making the company registration process in Malaysia simple, efficient, and fully compliant with local laws. This blog is designed to guide you through the essentials of setting up a company in Malaysia and help you choose a structure that supports your start-up’s goals now and in the future.

What Are the Types of Business Structures in Malaysia for Start-ups?

When launching a start-up in Malaysia, selecting a business structure that supports agility, growth, and financial practicality is important. Here are some of the most suitable options:

Sole Proprietorship

A sole proprietorship is the most straightforward and affordable business structure. It is owned and operated by a single person. However, the owner is personally liable for all business debts and liabilities. Sole proprietorships are perfect for entrepreneurs launching a small business with minimal risk or capital. They are fast and cheap to register, but they offer no personal liability protection. They are ideal for freelancers or home-based businesses just starting out.

Pros:

- Easy and inexpensive to set up.

- Complete control over business decisions

- Fewer regulatory requirements

Cons:

- Unlimited personal liability

- Harder to raise capital

- The business ceases to exist if the owner passes away

Partnership

A partnership is formed when two or more people agree to run a business together. There are two types: conventional partnerships and limited liability partnerships (LLPs).

Pros:

- Shared financial burden and skills

- Less formality than a company

- Easy to set up

Cons:

-

- Unlimited liability for general partnerships

- Risk of disputes among partners

- Profit-sharing can sometimes be unequal.

Private Limited Company (Sdn Bhd)

A Sdn Bhd is the most popular business structure in Malaysia. It is a separate legal entity from its owners, providing limited liability protection. This is the go-to structure for scalable start-ups. A Sdn Bhd allows you to bring in investors, protect personal assets, and establish long-term credibility. As of 2025, small Sdn Bhd companies that qualify can also enjoy audit exemptions, reducing administrative costs during the crucial early stages.

Pros:

- Limited liability for shareholders

- Easier to raise capital

- Business continuity even if owners change

- Eligible for audit exemption

Important Note: From 1 January 2025, CCM’s new audit exemption rules will apply based on annual income, total assets, and employee count—removing the need for “dormant,” “zero-revenue,” or “small” classifications. Dormant companies inactive for over two years still qualify automatically. Public, foreign, exempt private companies, and listed subsidiaries are excluded. The new thresholds will roll out in phases over three years to ease the transition and reduce compliance for small businesses.

Cons:

- More regulatory compliance

- Higher setup and maintenance costs

- Requires at least one director and one shareholder

Limited Liability Partnership (LLP)

An LLP combines the benefits of a partnership with limited liability, making it an ideal choice for professional firms and small businesses that want to protect their personal assets while retaining management flexibility. An LLP is an excellent option for two or more founders who want to limit personal liability while retaining flexibility in management and profit-sharing. It’s beneficial for professional services and small, growing teams.

Pros:

- Limited liability for partners

- Flexibility in management and profit-sharing

- No mandatory audits (for small businesses)

- Separate legal entity status

Cons:

- Some compliance requirements still apply.

- Less suitable for businesses planning to scale rapidly or go public

Public Limited Company (Bhd)

A Public Limited Company (Berhad or Bhd) is suitable for larger businesses aiming to raise capital from the public or list on the stock exchange. This structure allows the sale of shares to the public and is subject to more stringent regulatory oversight.

Pros:

- Ability to raise substantial capital through public share offerings

- Greater credibility and visibility

- Separate legal entity with limited liability for shareholders

Cons:

- High compliance and disclosure requirements

- Requires a minimum of two directors and usually a company secretary

- Subject to scrutiny by regulatory bodies such as Bursa Malaysia and the Securities Commission

How to Choose the Right Business Structure in Malaysia?

When selecting a business structure in Malaysia, consider the following factors:

Liability

Determine your risk tolerance and the level of personal liability you are willing to accept. If limiting personal liability is a priority, consider structures like an LLP, Sdn Bhd, or Bhd.

Taxation

Different business structures have varying tax implications. Sole proprietorships and partnerships are taxed on personal income, while companies and LLPs are subject to corporate tax rates. You can assess your potential tax liability and consult with a tax adviser to make an informed decision.

Capital Requirements

Could you evaluate your initial and ongoing capital needs? Public and private companies can raise capital by issuing shares, whereas sole proprietorships, partnerships, and LLPs may have more limited access to financing options.

Management and Control

Please review how you would like to manage and control your business. Sole proprietorships offer complete control, while partnerships and LLPs require shared decision-making. Companies have a more formalised management structure.

Compliance and Regulatory Requirements

Understand the compliance obligations associated with each business structure. Public and private companies have more stringent reporting and compliance requirements than sole proprietorships, partnerships, and LLPs.

Long-term Goals

Align your business structure with your long-term goals. If you plan to expand or go public, a more suitable company structure may be necessary, such as a Bhd or Sdn Bhd. A sole proprietorship, partnership, or LLP might suffice for smaller, lifestyle businesses.

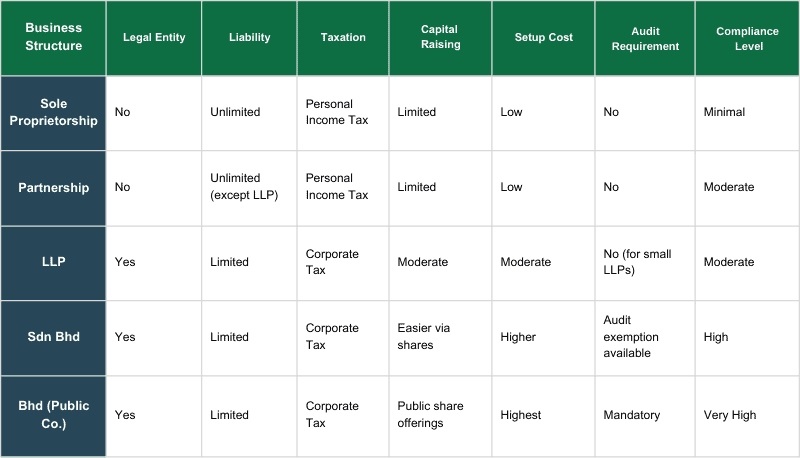

Comparison of Business Structures in Malaysia

Selecting the proper business structure is a crucial early decision for any Malaysian startup. Understanding each structure’s distinct features and implications empowers you to choose the one that best aligns with your current needs and aspirations. Here is the comparative analysis of the most common business structures in Malaysia:

Changing Your FYE: Step-by-Step Process

ACRA allows you to change your FYE in compliance with the provisions of the Singapore Companies Act and ACRA guidelines. Below is the step-by-step process:

Check Eligibility

Confirm that your Annual Return due date has not passed.

Determine Approval Requirements

In some cases, ACRA’s approval is required for changes.

Board Resolution

Pass a resolution to approve the FYE change.

Notify Authorities

Submit the change via:

- BizFile+ for ACRA

- Corporate Tax Portal for IRAS (if applicable)

Update All Records

Reflect the updated FYE in your internal and external financial documents.

Conclusion

Choosing the proper business structure is crucial to your liability, taxes, and overall business operations. Consider your business goals, risk tolerance, and growth plans when choosing. When setting up a company in Malaysia, there’s no one-size-fits-all solution. Choosing the proper structure is about finding what works best for your start-up’s goals, financial capacity, and long-term vision. Proper guidance is crucial when considering a straightforward sole proprietorship, a flexible LLP, or planning a full-fledged Sdn Bhd or Bhd company incorporation in Malaysia.

At 3E Accounting Services, we provide comprehensive support for Malaysian company registration, incorporation, and ongoing compliance requirements. Our experienced team can help you evaluate your options, complete the necessary documentation, and get your business up and running efficiently—whether you’re setting up a company in Malaysia for the first time or restructuring an existing one.

Don’t let paperwork and legal procedures slow you down. Let 3E Accounting be your trusted partner in your Malaysian company setup journey. Contact us today for expert advice in selecting the right business structure for your business in Malaysia.

Get Started with Your Malaysian Business Today

Take the first step towards your entrepreneurial journey. 3E Accounting will guide you from business structure selection to full company incorporation in Malaysia—hassle-free.

Frequently Asked Questions

The country’s thriving economy, highly skilled workforce, and a government committed to pro-business policies also make it an ideal destination for both new enterprises and multinational corporations.

It depends on your goals. A Sdn Bhd is great for scalability and investor confidence, while sole proprietorships and LLPs offer simplicity and flexibility for smaller ventures.

Yes, foreigners can register a Sdn Bhd in Malaysia, but they must meet local regulatory requirements, including appointing at least one resident director.

Small businesses that involve website design, a subset of digital marketing, are among those that make the most sales and profit. People learn about online businesses more often than via other avenues, so finding clients and a steady income stream isn’t as difficult.

Abigail Yu

Author

Abigail Yu oversees executive leadership at 3E Accounting Group, leading operations, IT solutions, public relations, and digital marketing to drive business success. She holds an honors degree in Communication and New Media from the National University of Singapore and is highly skilled in crisis management, financial communication, and corporate communications.