Choosing a legal structure is important to start a business in Malaysia. Various business entities are available; among them, Sendirian Berhad (Sdn Bhd) is the most common type of private limited company in Malaysia, offering numerous advantages to entrepreneurs and businesses. Whether you are a local or foreign investor, understanding what an Sdn Bhd company is and how it operates is crucial for your business success.

In this blog, we will break down the concept of an Sdn Bhd company in Malaysia, its key features, benefits, the registration process, compliance requirements, and why to choose Sdn Bhd in Malaysia.

What is a Sendirian Berhad (Sdn Bhd) Company?

A Sendirian Berhad (Sdn Bhd) is a private limited company structure that locals and foreigners in Malaysia can incorporate. Sdn Bhd should be registered through Suruhanjaya Syarikat Malaysia (SSM). Entrepreneurs in Malaysia and other countries commonly use this business entity. It provides limited liability protection for shareholders and has a separate legal entity, allowing it to enter into contracts, own assets, and conduct business transactions in its name.

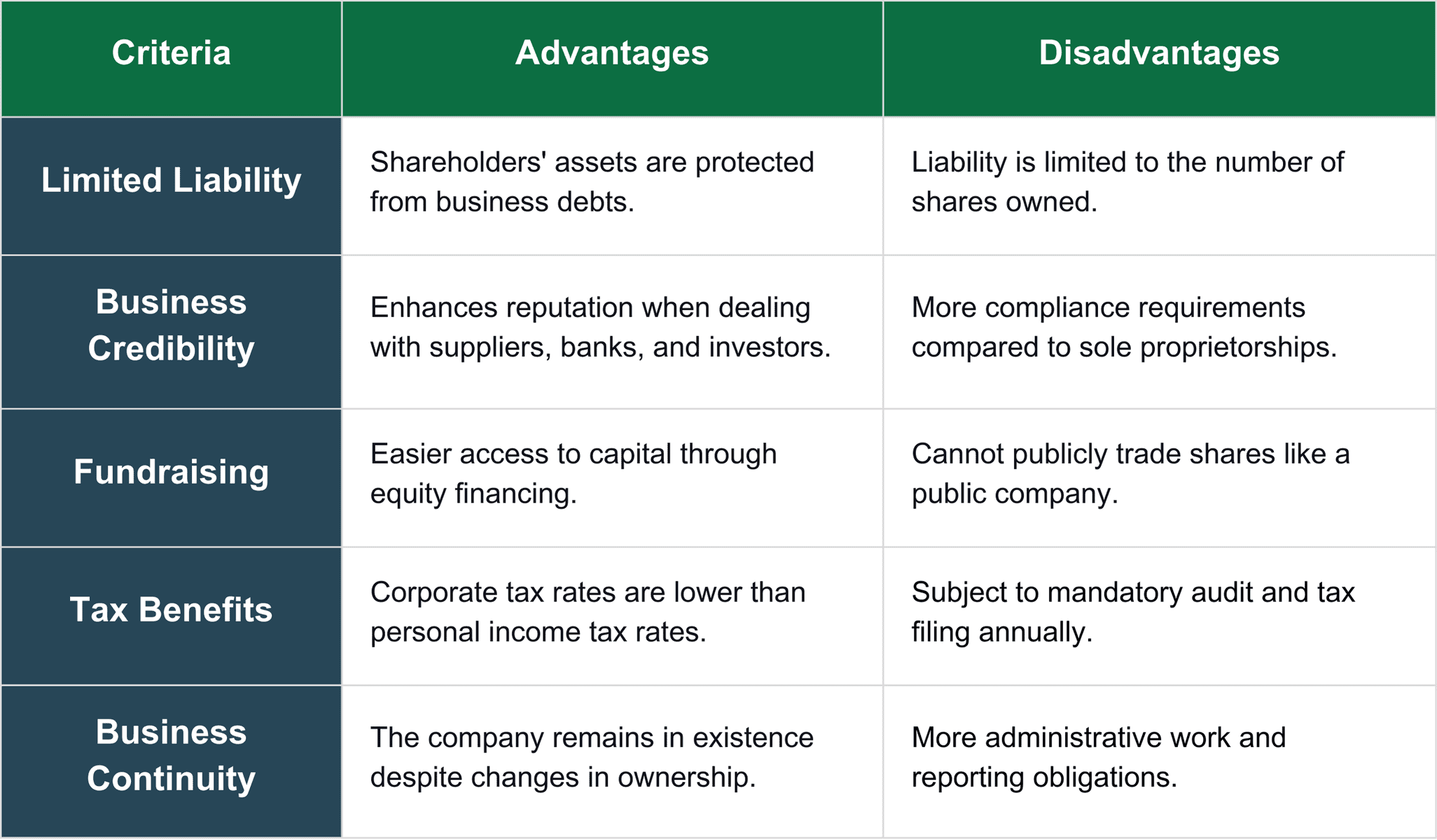

Due to its benefits and protections, the Sdn Bhd structure is a popular option for entrepreneurs seeking to establish a business in Malaysia. With limited liability protection, entrepreneurs can protect their assets from the company’s liabilities, while having a separate legal entity allows for easier management of business transactions. Additionally, the legal framework in Malaysia is relatively business-friendly, with well-defined rules and regulations that make it easier for entrepreneurs to start and run a business in the country.

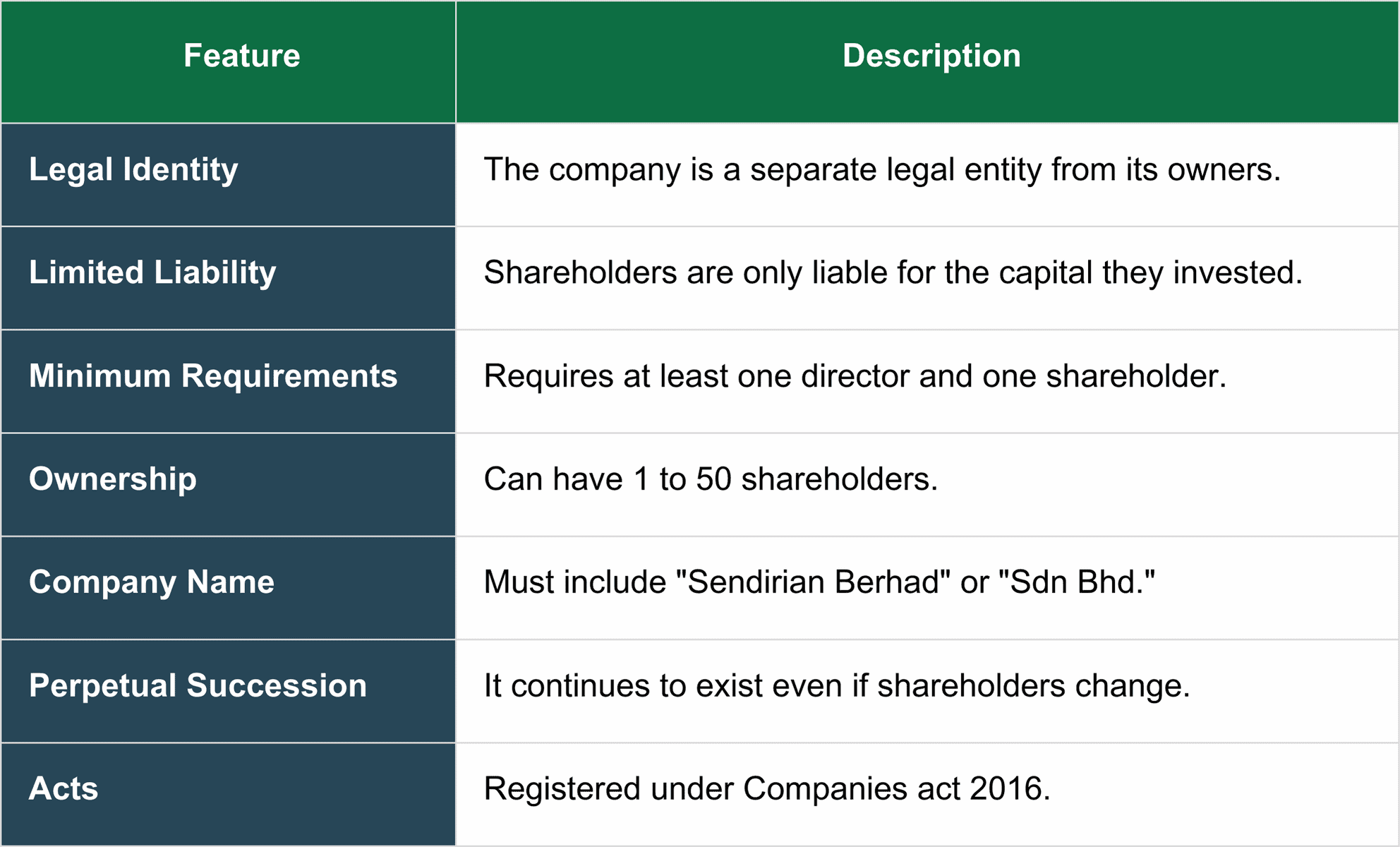

Key Features of an Sdn Bhd Company

A Sendirian Berhad (Sdn Bhd) company is the most common type of private limited company in Malaysia. It is a preferred choice for small and medium-sized enterprises (SMEs) due to its limited liability protection, separate legal identity, and business-friendly structure. Below are some key features of a Sdn Bhd Company

Step-by-Step Registration Process

Registering a Sendirian Berhad (Sdn Bhd) company in Malaysia is done through the Companies Commission of Malaysia (SSM). Below is a detailed step-by-step guide to help you through the process.

Pre-Incorporation:

1.Choose and Reserve Your Company Name

- Start by checking that your desired company name is available using MyCoid portal .

- Make sure the name follows SSM guidelines (it shouldn’t include any prohibited words).

- Once you’re happy with the name, reserve it for RM50—it’s held for 30 days (you can extend if needed).

2.Gather Your Details and Documents

- Prepare your company’s basic details: name, business activities (you’ll need the relevant MSIC code), and your registered/business address.

- List your directors and shareholders. Remember, you need at least one director who is a Malaysian resident.

- Decide your paid-up capital (minimum RM1 is required, banks might ask for more later).

- Arrange for a licensed Company Secretary, as they are essential for compliance.

3.Submit Your Application to SSM

- Log in to the MyCoID Portal and fill out the Super Form with your company details, directors, and shareholders.

- Upload copies of the NRIC or passport for everyone involved.

- Pay the registration fee.

- After a quick processing time (usually 1–3 days), you’ll receive your Certificate of Incorporation under Section 17 of the Companies Act 2016.

Post-Incorporation: After Your Company Is Registered

1.Appoint Your Company Secretary

- Make sure to formally appoint a licensed company secretary within 30 days of registration.

2. Appoint an Auditor (If Required)

- Unless your company qualifies for an audit exemption, you must appoint an auditor within 30 days from incorporation or before submitting your first financial statements.

- In Malaysia, Sdn Bhd companies must undergo an annual audit by a licensed auditor as per the Companies Act 2016 to ensure financial transparency and compliance. Exceptions apply to companies if they satisfy certain conditions and fulfil the eligibility criteria for exemption.Recently the Companies Commission of Malaysia (CCM) announced new rules for audit exemptions which is discussed in detail in this blog.

3.Get All Your Company Documents in Order

- Hold onto your Certificate of Incorporation, the Super Form, any board resolutions you’ve passed, and your Company Constitution if you have one.

4.Open a Corporate Bank Account

- Choose a bank that fits your needs—popular options include UOB, CIMB, Maybank, RHB, Public Bank, HSBC, and Standard Chartered.

- Prepare the documents:

- Certificate of Incorporation (Section 17)

- Super Form

- A Board Resolution authorizing the bank account opening

- NRIC or passport copies for directors

- Business address proof (if needed)

- The bank typically takes 1–2 weeks to set up your account.

5.Register for Taxes and Other Compliance

- Sign up with the Inland Revenue Board (LHDN) for corporate tax.

- If you plan to hire employees, register for EPF, SOCSO, and EIS.

6.Submit Annual Returns & Keep Financial Records:

- Submit your Annual Return to SSM within 30 days of your incorporation to update company details, including directors and shareholders.

- Keep proper financial records and ensure financial statements are audited unless exempt.

- Submit financial statements to SSM within 7 months after your financial year-end.

- Keep financial records for at least 7 years for compliance and future reference.

7.Apply for Any Additional Business Licenses

- You might need extra licenses depending on your industry (like F&B, retail, or import/export).

Audit Exemption 2025: Key Changes for Sdn Bhd Companies

The Companies Commission of Malaysia (CCM) announced new rules for audit exemptions, making it easier for small businesses to comply. Starting 1 January 2025, companies will no longer be classified as dormant, zero-revenue, or small to qualify for exemption. Instead, eligibility will be based on three simple factors: annual income, total assets, and the number of employees. However, this exemption won’t apply to public companies, foreign companies, exempt private companies, or subsidiaries of listed companies. Dormant companies (inactive for two years) automatically qualify for exemption.This change is designed to lighten the burden on small businesses while still ensuring financial accountability.

To ease the transition to the new audit framework, the threshold criteria for audit exemption will be rolled out in phases over a 3-year period and will increase incrementally.

New Audit Exemption Rule – Phase 1 (2025)

Starting 1 January 2025, Phase 1 of Malaysia’s new audit exemption rules allows Sdn Bhd companies to skip audits if they meet any two of these conditions:

- Annual revenue ≤ RM1 million (Annual revenue must not exceed RM 1,000,000 for the current and two preceding years.)

- Total assets ≤ RM1 million ( Total assets in the financial position statement must not exceed RM 1,000,000 for the current and two preceding financial years)

- Employees ≤ 10 (The number of full-time employees excluding directors shareholders and irregular wages must not exceed 10 at the end of the current and two preceding financial year)

The new audit exemption framework aims to simplify regulations, reduce costs for small businesses, and promote growth. Companies should assess their financials and employee numbers to determine whether they qualify for exemption under the new rules.

Details on Phase 2 (2026) and Phase 3 (2027) can be found in the FAQ section.

Conclusion

In conclusion, setting up a Sdn Bhd company in Malaysia can be a smart business move, offering a range of benefits and advantages. From limited liability protection to tax incentives and ease of registration, a Sdn Bhd company can provide a solid foundation for growth and success. By understanding the requirements and benefits of Sdn Bhd company registration, businesses can make informed decisions and establish a strong presence in Malaysia’s vibrant business community.

If you want to register an Sdn Bhd company in Malaysia, 3E Accounting Services can help you with the entire process, ensuring a smooth and hassle-free experience.

At 3E Accounting, we understand the complexities of business registration, compliance, and taxation in Malaysia. With our cost-effective, efficient, and results-driven approach, we provide expert guidance to help you make informed decisions and ensure seamless business incorporation.

Register Your Sdn Bhd Company Today

Make incorporation easy with 3E Accounting Services—your one-stop solution for registering and managing your Sdn Bhd company!

Frequently Asked Questions

An Sdn Bhd (Sendirian Berhad) is a private limited company with limited liability, protecting shareholders’ assets. Unlike publicly listed Bhd companies, its shares are privately held, ensuring more control. It is a separate legal entity, making the business—not owners—liable for debts. With a structured management system, it offers stability and credibility.

Both locals and foreigners can establish a Sdn Bhd in Malaysia. It requires at least one resident director and 1–50 shareholders, either individuals or companies.

Yes,a foreigner can own 100%of the shares in a Sdn Bhd company,but they must still appoint a local director.

No shareholder of Sdn Bhd shall be a natural or legal person, i.e. LLP, Sdn Bhd or Public company(Berhad).

Threshold will progressively increase each year from 2025 to 2027 with a maximum turnover,asset value and employee count of RM 3,000,000 and 30 employees respectively by 2027.

Abigail Yu

Author

Abigail Yu oversees executive leadership at 3E Accounting Group, leading operations, IT solutions, public relations, and digital marketing to drive business success. She holds an honors degree in Communication and New Media from the National University of Singapore and is highly skilled in crisis management, financial communication, and corporate communications.