Malaysia’s business-friendly environment attracts entrepreneurs and investors from all around the world. Conducting any type of business in Malaysia requires a registered legal entity. Registration must be completed within 30 days of starting operations, as conducting business without a legal entity is punishable by law.

The Companies Commission of Malaysia or the Suruhanjaya Syarikat Malaysia (SSM) oversees all business registrations. The first and most important step before registering your business is to select the appropriate legal structure or type of entity. When starting a business in Malaysia, selecting the right business entity is crucial. This decision impacts taxation, liability, ownership, and overall business operation.

This blog will provide a comprehensive overview of the five most popular types of business entities in Malaysia that can be registered. We will explore the advantages and disadvantages of each type, along with other essential details, to help you make an informed decision.

Types of Business Entities in Malaysia

Sole Proprietorship

A sole proprietorship or enterprise is a business that is owned by a single individual owner under the Business Registration Act 1956. It is the simplest business entity to get started with if you are thinking of starting a small business yourself. You can register a Sole Proprietorship using your name or a trade name. This can be done online via Ezbiz Online services or over the counter at SSM (Suruhanjaya Syarikat Malaysia).

Characteristics of a Sole Proprietorship

- It is owned by just one individual, and the business has unlimited liability.

- Only Malaysian citizens or permanent residents (PRs) can set up a Sole Proprietorship.

- All profits and losses go directly to the business owner.

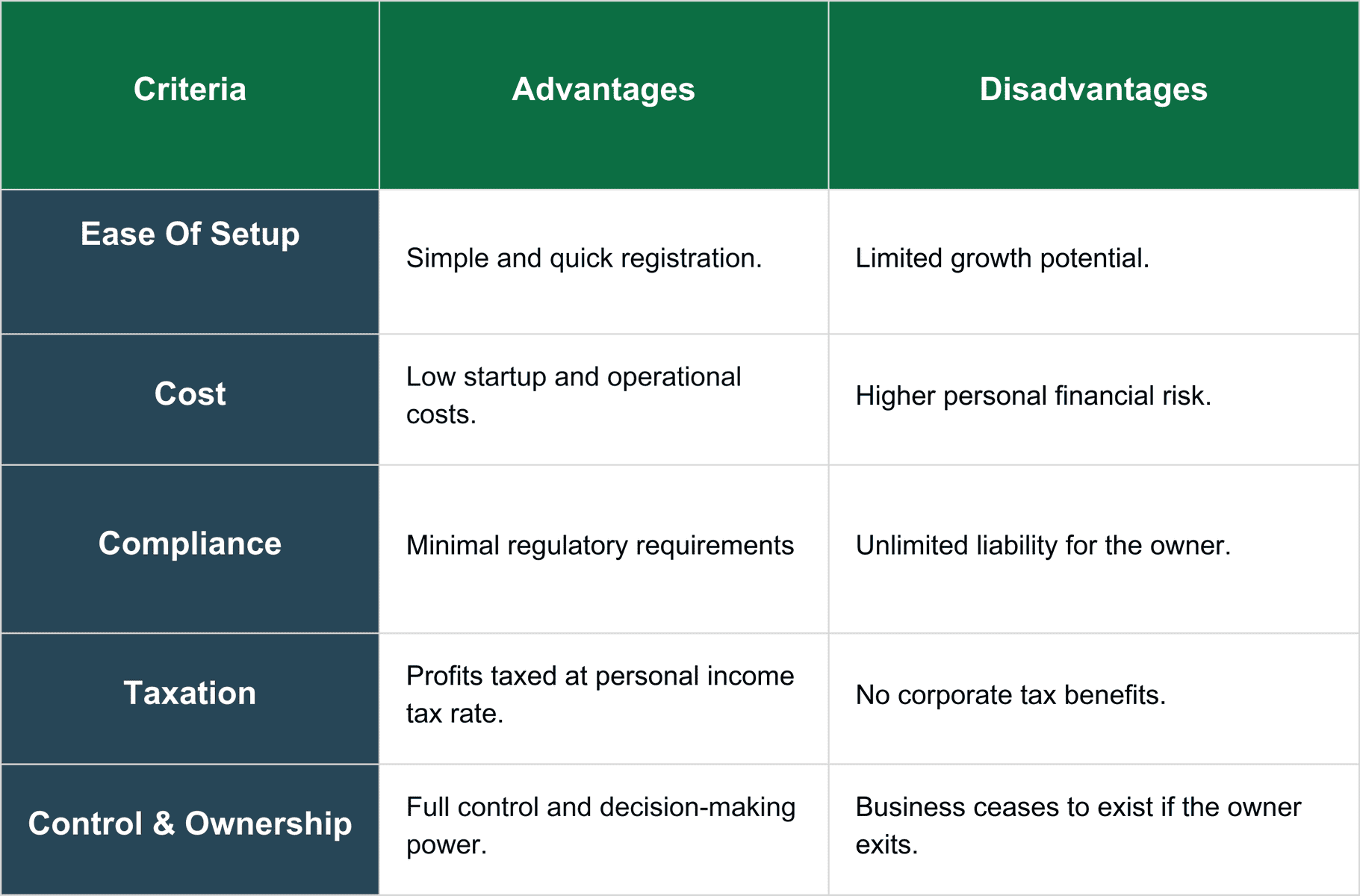

Advantages and Disadvantages of Sole Proprietorship

Partnership

A Partnership business is similar to a sole proprietorship, except it has more than one (1) owner but not more than 20 owners. This type of business is according to the Partnership Act 1961. Usually, the capital used for this business is small and can be raised by the owner’s assets or borrowed from friends, family, and bank loans. The company’s profit can be distributed according to the amount of capital, labour and under agreement from the partnership members. Losses are also shared equally. An example of a partnership business is accounting firms, law firms and so on.

Characteristics of a Partnership

- It is jointly owned by two or more individuals – a maximum of twenty (20) partners.

- It is governed by the Partnership Act 1961 or self-created partnership agreements.

- Only Malaysian citizens or permanent residents (PRs) can set up a partnership.

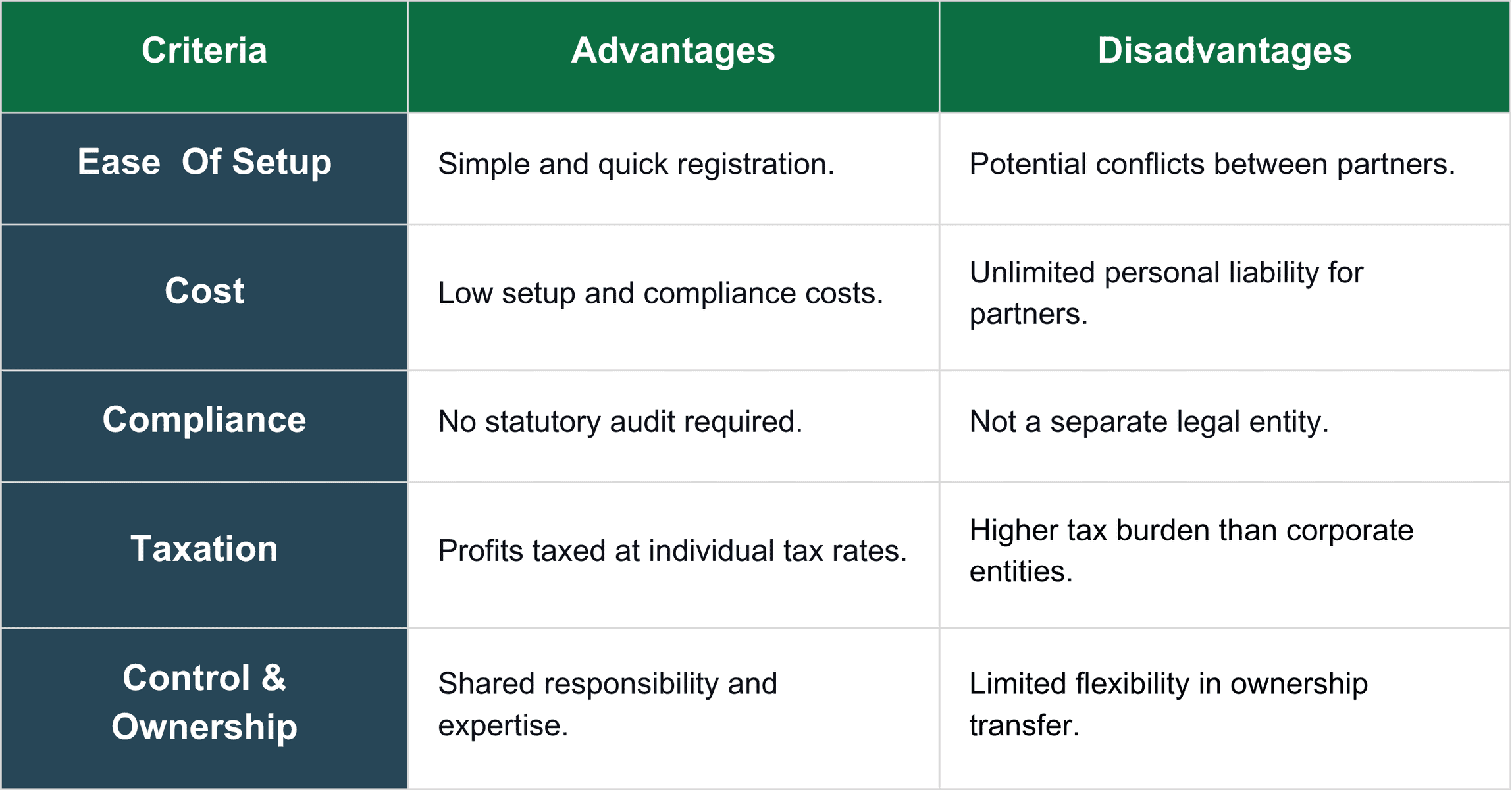

Advantages and Disadvantages of a Partnership

Private Limited Company/Sendirian Berhad (Sdn Bhd)

A Sdn Bhd company is a private company limited by shares. It is a separate entity from its owners, which means the owners are liable only for the amount they have contributed to the company. If you are looking to run an SME business, a Sdn Bhd is considered a more creditworthy and formal business structure as compared to a Sole Proprietorship or Partnership

Characteristics of Sdn Bhd

- A private limited company can have 1 to 50 shareholders. You can be the only director/shareholder of the company without other business partners.

- Open to non-Malaysians, but at least one director must be a Malaysian resident.

- A minimum paid-up capital of RM1.

- It can carry on business, enter into a contract, and sue or be sued.

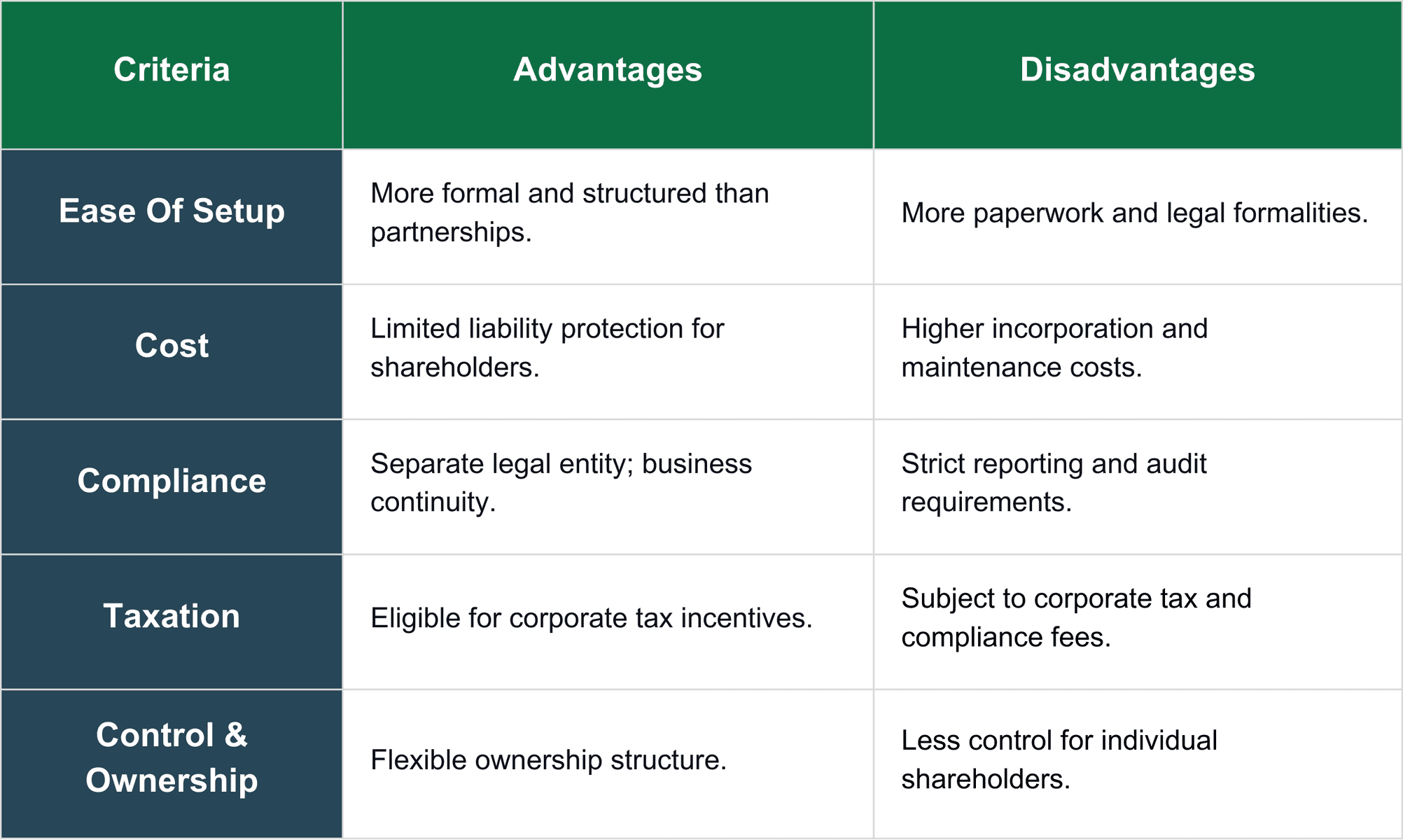

Advantages and Disadvantages of a Private Limited Company (Sdn Bhd)

New Audit Exemption Rule – Phase 1 (2025)

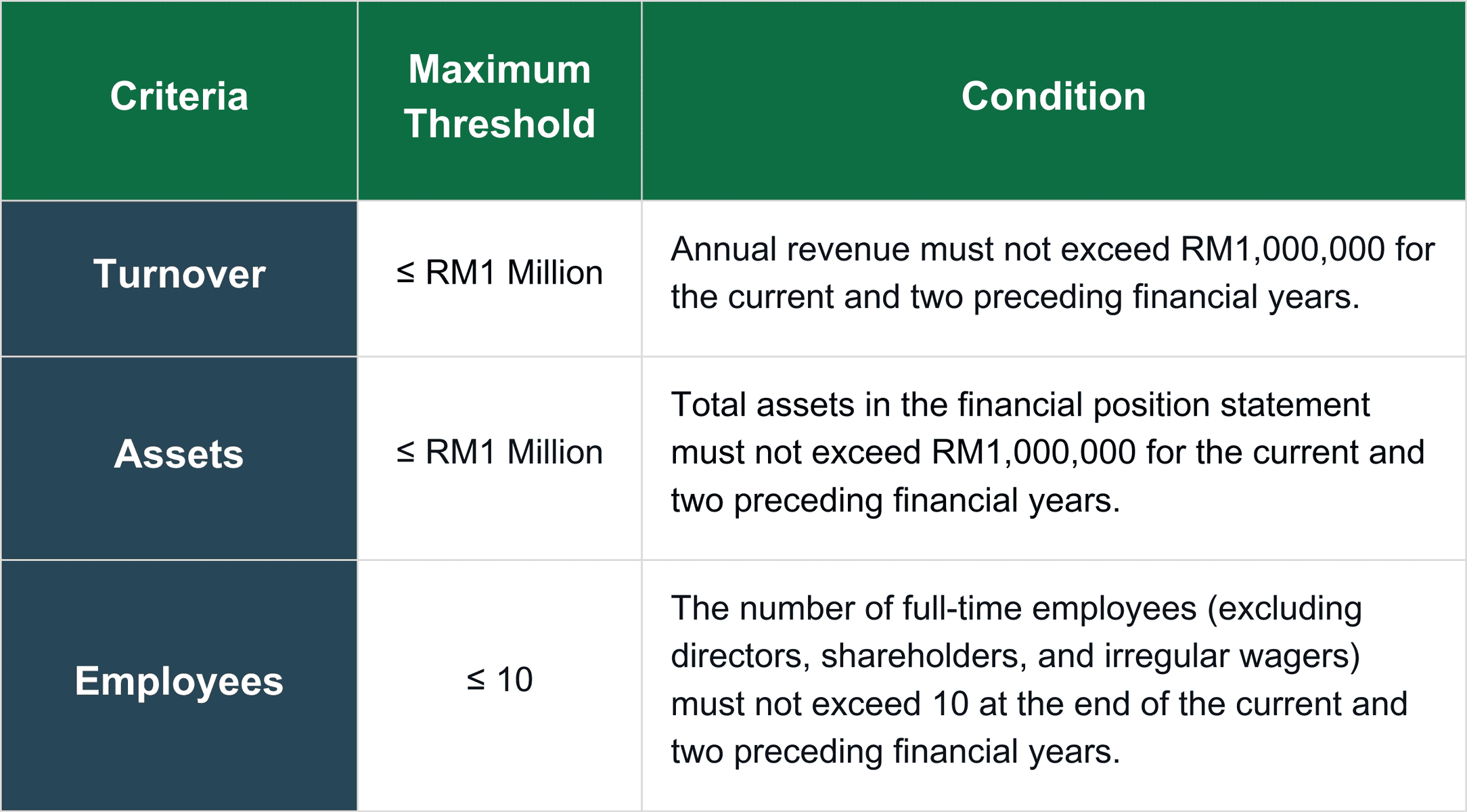

The Companies Commission of Malaysia (CCM) has introduced a new audit exemption framework to ease the burden on small businesses.

Effective 1 January 2025, Malaysia’s new audit exemption criteria replace previous exemptions with a threshold-based approach.

Private companies (excluding foreign, public, exempt private, and subsidiaries of listed companies) may qualify if they meet any two (2) of the following three (3) criteria:

This change helps small businesses reduce costs while maintaining compliance. Companies should ensure their financial records for the current and past two financial years stay within the limits.

Public Limited Company/Berhad (Bhd)

A Bhd company is an entity whereby shares of the company are offered for purchase to the public. A Sdn Bhd is usually converted to Bhd to raise public funds. The capital can be raised from the public through an initial public offering (IPO). Traditionally, a Bhd company raises capital through an Initial Public Offering (IPO), though recent alternatives include Reverse Takeovers (RTO) or listing via a SPAC (Special Purpose Acquisition Company) acquisition / offering.

Characteristics of a Bhd

- Unlimited number of shareholders.

- Public listed on Bursa Malaysia Stock Exchange and governed by Securities Commission of Malaysia

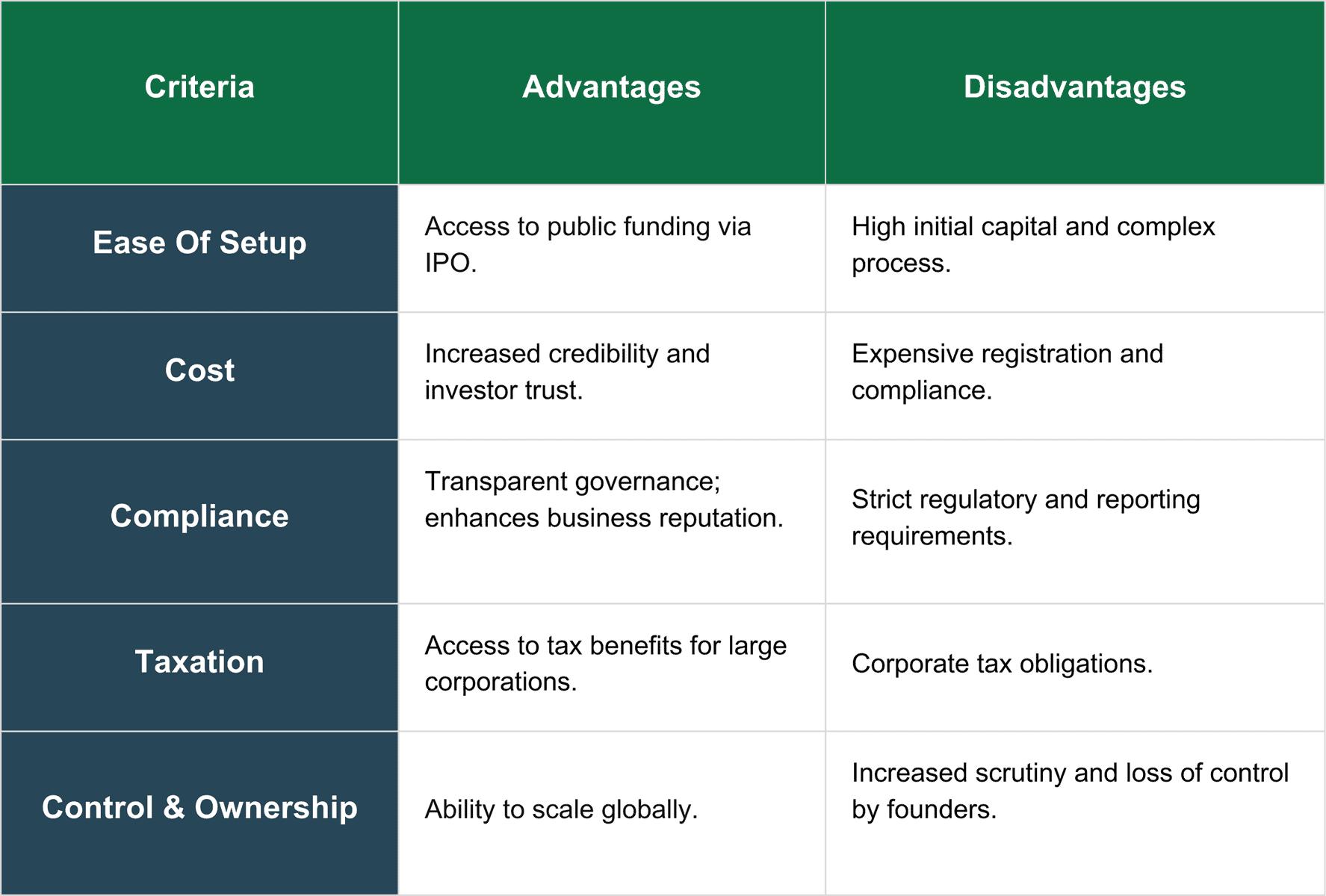

Advantages and Disadvantages of a Public Limited Company (Bhd)

Limited Liability Partnership (LLP)

An LLP is a relatively new corporate structure governed under the Limited Liability Partnership Act 2012. It is a combination of a private limited company and a Partnership.

Characteristics of an LLP

- A minimum of 2 partners are needed to form an LLP – no maximum number of partners.

- Only Malaysian citizens or permanent residents (PRs) can set up an LLP

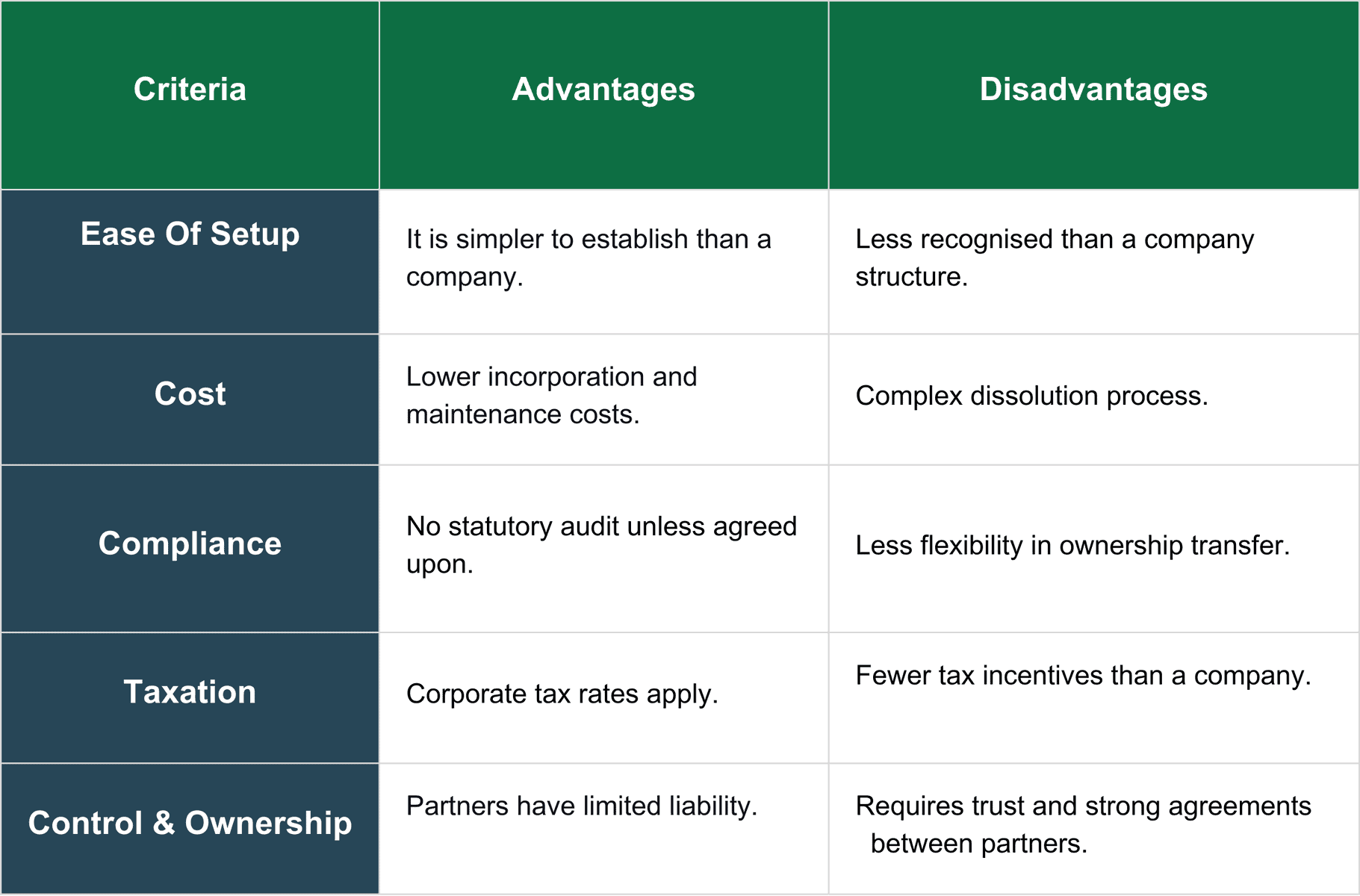

Advantages and Disadvantages of an LLP

Key Factors to consider when starting a business in Malaysia

Before registering your business in Malaysia, it’s crucial to carefully consider the form of business entity you want to establish. Whether you opt for a company, LLP, partnership, sole proprietorship, or another structure, each entity has its own set of advantages, compliance requirements, fees, rebates, structures, and taxation implications.

Here are some key factors to consider when selecting the appropriate legal entity and setting up business in malaysia:

Ownership structure and control : Determine the ownership structure that suits your business including the number of owners, their roles and responsibility.

- Liability protection and risk management: Consider the level of personal liability protection you need, as some other entities offer more protection than others.

- Tax implications and benefits: Understand the tax implications of each entity type, including income tax, sales tax and other levies

- Compliance requirement : Understand the compliance and regulatory requirements for each entity type,including registration, reporting and licensing

- Continuity and transferability : Determine whether you are establishing a venture for perpetual, long-term, or short-term purposes and whether you anticipate transferring ownership in the future. Companies offer perpetual continuity and allow for the transfer of ownership, while sole proprietorships terminate with the proprietor.

Conclusion

Choosing the right business entity in Malaysia requires a thorough understanding of the options available and implications of each. By carefully evaluating the options and researching, you can make an informed decision supporting your business vision and strategy. Each entity type offers advantages and disadvantages, impacting liability protection, taxation, management flexibility, and regulatory compliance.

Once the right business entity form has been identified, entrepreneurs can proceed with the registration process with the Companies Commission of Malaysia (SSM).

At 3E Accounting, we understand the complexities of business registration, compliance, and taxation in Malaysia. With our cost-effective, efficient, and results-driven approach, we provide expert guidance to help you make informed decisions and ensure seamless business incorporation.

Ready to establish your business in Malaysia?

Partner with 3E Accounting Services, your one-stop solution for corporate solutions

Frequently Asked Questions

The most common types of business entities in Malaysia are Sole Proprietorship, Partnership , Limited Liability Partnership (LLP), Private Limited Company (Sdn Bhd), And Public Limited Company (Berhad).

Yes, it is possible to change your business entity type after registration, but this may involve additional paperwork and fees. It’s advisable to consult with a business advisor to determine the best course of action.

Yes, a business entity in Malaysia can have foreign directors or shareholders, but there may be certain restrictions or requirements.

Registering with the Companies Commission of Malaysia (CCM) or the Registrar of Business. Registration typically takes two to five working days but may vary depending on entity type.

A Private Limited Company, known as Sendirian Berhad (Sdn Bhd), is the most common type of business entity in Malaysia. This form of entity is favoured by most entrepreneurs and small to medium-sized enterprises (SMEs) due to its flexibility and limited liability benefits.

To choose the right business entity in Malaysia, factors such as liability, taxation, ownership structure, and scalability must be considered.