Malaysia Service Tax 2018

Malaysia’s Service Tax is a form of indirect tax imposed on any provision of taxable services made in the course or furtherance of any business by a taxable person in Malaysia. Service tax is not chargeable on imported services and exported services.

*update* To ensure that our local service providers are not unfairly disadvantaged against their foreign competitors, Service Tax be imposed on the taxable services imported into Malaysia. The imposition of Service Tax on imported services will be carried out in 2 phases, services imported by Malaysian businesses from 1 January 2019 while services imported by Malaysian consumers from 1 January 2020.

In general, the services provider is liable to be registered under the Service Tax Act 2018 when the value of taxable services provided for a period of 12 months that exceeds a threshold of RM500,000. The SST registration threshold is RM1,500,000 for Operator of restaurant, bar, snack-bar, canteen, coffee house or any place which provides food and drinks (eat-in or take-away , exclude canteen in an educational institution or operated by a religious institution or body), Caterer and Food court operator.

Refer to the Service Tax Threshold Table for more information.

The Service Tax Rate is fixed at 6% (1 September 2018 to 29 February 2024) and changed to 8% (effective from 1 March 2024) except for food & beverage services, telecommunication services, parking services and logistics services will be at 6%. A specific rate of tax of RM25 is imposed upon issuance of principal or supplementary card and every subsequent year or part thereof.

The following taxable services are subject to the service tax:

- Hotel (include lodging house, service apartment, homestay, Inn, rest house, boarding house)

- Insurance and Takaful

- Service of food and beverage preparation (include restaurant, cafe, catering, take-away, food truck, retail outlet, hawkers and etc)

- Club (include nightclubs, dance halls, cabarets, karaoke centre, health and wellness centres, massage parlous, public houses, and beer houses.)

- Gaming (include Casino, game of chance, sweepstakes, gaming machines, lottery, betting)

- Telecommunication

- Pay-TV

- Forwarding agents

- Legal

- Accounting

- Surveying

- Architectural

- Valuer

- Engineering

- Employment agency

- Security/ Private Agencies

- Management services

- Consultancy, training & couching services

- Information Technology services

- Digital Services

- Parking

- Motor vehicle service or repair

- Courier

- Hire and drive car

- Advertising

- Domestic flight except Rural Air Services

- Credit or charge card

- Electricity

- Logistics services (effective from 26 February 2024)

- Maintenance and Repair Services (effective from 1 March 2024)

However, the service tax cannot be levied on any services that are not in the list of taxable service.

Updates on Service Tax effective from 27 November 2024

- Intra-Group Relief expanded to include Maintenance or Repair Services. Previously, the relief was only available for certain services in Group G Professional Services. Effective retrospectively from 1 May 2024, maintenance or repair services can also enjoy this relief.

- Registered practitioners who provide Traditional and Complementary Medicine (TCM) services will be excluded from the scope of taxable persons for service tax under Group C (Clubs) and will no longer be subject to service tax.

- Maintenance or repair services is amended to exclude maintenance or repair services provided for goods and equipment fixed to the structure of a Residential Properties. Such services must be provided directly to the owner or resident of the residential property.

- The item (d)(vi) of the taxable service under Group E – Golf club and golf driving range is amended to “provision or sale of alcohol and non-alcoholic beverages” by deleting the word “food”.

Exemption on Service Tax

The service tax is not chargeable for the following:-

1. Exported services

Taxable services provided for goods or land situated outside Malaysia, or taxable services related to overseas project outside Malaysia, and exported services are exempted from the service tax.

2. Intra-Group Relief

Where a company provides taxable service which are solely provide to a company within the same group of companies, by both a local company as well as a company outside Malaysia (imported taxable services), the company is eligible for intra-group relief and is not subject to service tax.

Such taxable services that can enjoy this group relief are only those under Group G – Professional Services (exclude employment services and private agencies):

- Legal

- Accounting

- Surveying

- Architectural

- Valuer

- Engineering

- Management services

- Consultancy, training & couching services

- Information Technology services

- Digital services

- Maintenance and Repair Services (effective retrospectively from 1 May 2024)

However, when the same service is provided to any external third party who not in the same group of companies, the company will no longer be eligible to group relief and will subject to service tax. Effective 1 January 2020, if the total value of the service to the third party does not exceed 5% of the total value of the service within 12 months, company is still eligible to group relief if fulfill this 5% rule.

Please note that 5% rule does not apply to imported service tax. Only applicable to local service providers in a group of companies. When overseas companies within the same group provide taxable services to external parties located overseas only, it still entitle to group relief. If provide services to external parties located in Malaysia, no more group relief and all imported taxable services are subject to SST.

3. B2B Exemption

This exemption only apply to certain taxable services provided by local service provider:

- Professional Services (Group G) – except Employment services and Private agency

- Advertising services (Group I)

- Logistics services (Group J)

To entitle to this exemption, it must fulfilled all of the conditions below:

i. both service provider and recipient of taxable service must be a SST registered persons;

ii. they must registered under the same taxable service;

iii. they shall have same description of services in their invoice;

iv. the service is not for personal consumption; and

v. there is a third party who is the end customer

Please note that the local service provider is responsible to include SST registration number of the customer who enjoyed this exemption and total service tax exempted in the invoice. The total value of exempted taxable services shall be declare in the SST return by local service provider.

4. B2B Exemption on imported service tax

B2B exemption is also applied to imported service tax for foreign service providers.

To entitle to this exemption, it must fulfilled all of the conditions below:

i. recipient of the imported taxable service must be a SST registered person;

ii. the recipient provide same services to customers as imported taxable services acquired; and

iii. imported taxable service is for furtherance of business and not for personal consumption

Please note that the value of exempted imported taxable service is not required to be declared in SST return.

Accounting Basis for Service Tax

Companies shall prepare their SST return in payment basis for Service Tax purposes. Service Tax required to be accounted for at the time when the payments are received or on the day following period of twelve months when any whole or part of the payment is not received from the date of the invoice for the taxable service provided.

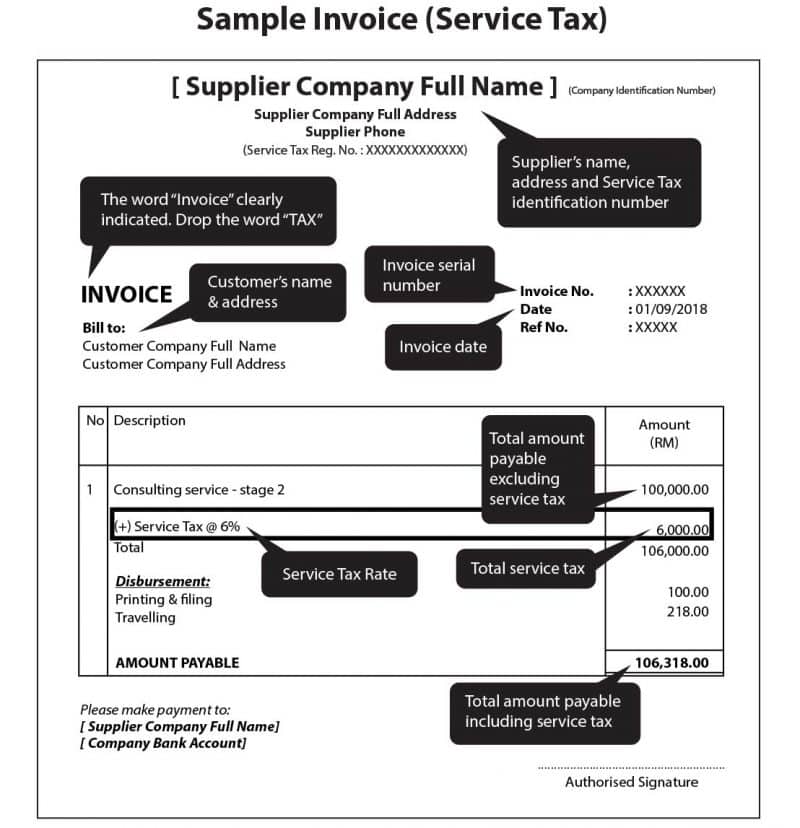

Companies who provide taxable services must issue invoices containing the prescribed particulars. The invoices can be in hardcopy or electronically, Bahasa Melayu or English. Any credit notes and debit notes issued shall make an adjustment in SST return.

Bad debts can be claimed by a registered person or a Ceased to be registered person. The bad debts can be claim after 6 months to 6 years from the date of service tax was paid and subject to condition and satisfaction of the DG. For bad debts recovered from the debtor after bad debts claimed and received the service tax refund, the registered person must repay the service tax refund to DG in his return.

The businesses must keep its records in Malaysia for 7 years. It is subjected to the DG approval for record keeping at overseas. The record can be kept in softcopy or hardcopy.